Chattel loans provide a unique avenue of financing, often applied for obtaining valuable assets. Unlike traditional loans, chattel loans leverage the purchased good itself as collateral. This means that if the borrower defaults on their payments, the lender has the right to take back the item.

Before venturing on a chattel loan, it's essential to thoroughly grasp the terms and conditions. This includes factors such as interest fees, repayment plans, and any possible penalties for missing payments.

- Evaluate your financial position carefully before applying for a chattel loan.

- Compare different lenders to find the most favorable rates and terms.

- Read the loan agreement meticulously before signing it.

Weighing the Ups and Downs of Chattel Lending

Chattel loan financing is a prevalent way for businesses to obtain assets. It requires using your existing possessions as pledge for a loan. While this type of financing can be a valuable chattel loans resource, it's essential to understand both the potential downsides and advantages.

- One potential danger is that if you fail to repay on your loan, you could lose your collateral. This can be particularly harmful if the property are essential to your operations

- On the other hand, chattel loans can offer attractive interest rates. They also often have adjustable repayment options to accommodate your financial needs.

Before entering into a chattel loan agreement, it's essential to meticulously review the terms and conditions. Make sure you understand the interest rate, repayment schedule, and any charges involved.

Chattel Loan Eligibility Criteria: What You Need to Know

Securing a chattel loan can be a valuable financial tool when you need quick funding for a specific asset. However, it's important to understand the eligibility criteria before applying to ensure you meet the lender's requirements. Typically, lenders will assess your financial history by reviewing factors such as your credit score, income, and debt-to-income ratio.

You'll also need to provide evidence of ownership for the collateral you're financing, as well as a clear understanding of its worth. By carefully considering these eligibility criteria and gathering the necessary documentation, you can increase your chances of acceptance for a chattel loan.

- Consider Your Credit Score: A higher credit score generally leads to more favorable lending terms.

- Showcase Stable Income: Lenders prefer applicants with consistent income streams to ensure repayment capability.

- Collect Proof of Asset Ownership: This documentation verifies your right to use the asset as collateral.

How to Secure a Chattel Loan for Your Business Equipment

Securing funding for vital assets can be a critical challenge for expanding businesses. A chattel loan offers a viable solution by leveraging your existing inventory as security.

To successfully obtain a chattel loan, follow these fundamental steps:

* First by exploring various lenders who offer chattel loans.

* Meticulously assess your business health.

* Gather all the required paperwork, including your current financial statements, tax returns, and business strategy.

* Develop a persuasive loan application that emphasizes the benefits of your assets.

* Negotiate loan terms meticulously to ensure they align your operational requirements.

Remember, a chattel loan can be a effective tool for acquiring essential business equipment.

By following these guidelines, you can maximize your likelihood of obtaining the financing you need to grow.

Alternatives to Chattel Loans: Exploring Other Financing Options

Chattel loans can be a convenient option for acquiring certain items, but they often come with high interest rates and strict conditions. Thankfully, there are several various financing options available that may better suit your circumstances.

Before diving into specific alternatives, it's crucial to evaluate your financial status and identify the type of funding you require. Once you have a clear picture of your budgetary objectives, you can explore the following options:

* **Microloans:** These tiny loans are structured to help borrowers with scarce credit background.

* **Personal Loans:** Free-standing personal loans can be used for a wide range of objectives, from merging debt to covering unexpected outlays.

* **Equipment Financing:** If you want financing for specific machinery, this choice allows you to use the equipment itself as security.

* **Grants and Subsidies:** Depending on your industry or endeavor, you may be eligible for government or private subsidies that do not need to be compensated.

Remember to thoroughly compare the terms and provisions of any financing alternative before making a selection.

Significance of a Thorough Chattel Loan Agreement

Securing a chattel loan is a essential decision for people. It provides access to capital for acquiring equipment, but it's imperative to understand the terms of the loan agreement before you sign. A comprehensive chattel loan agreement protects that both the lender and borrower are aware of their responsibilities. It specifies the amount being advanced, the financing cost, the terms, and any additional fees that may apply.

- Additionally, a well-drafted agreement defines the collateral being offered as repayment for the loan. This helps to reduce the risk for both parties involved.

- In essence, a thorough chattel loan agreement provides a structure for a successful lending relationship. It prevents disputes and ensures open communication.

Shaun Weiss Then & Now!

Shaun Weiss Then & Now! Brian Bonsall Then & Now!

Brian Bonsall Then & Now! Mike Vitar Then & Now!

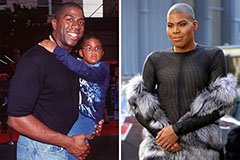

Mike Vitar Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! The Olsen Twins Then & Now!

The Olsen Twins Then & Now!